اطلب اقتباس

Is Cenvat Credit Available On Crusher

Service Tax- FAQ on CENVAT Credit Scheme - Tax Guru

2010/12/26 Credit should be taken only on that quantity of input /input services which are used for the service on which Service Tax is payable. (Ref. Rule 6 of Cenvat Credit

获取价格

CENVAT CREDIT – Recent Court Rulings Presented by: Ca.

not taking credit. Reversal of cenvat credit amounts to non-taking of credit on the inputs. • Commissioner Of Central Excise, Bangalore-II vs. Pearl Insulation Ltd. 2012 (27) STR

获取价格

CENVAT Credit Rules, 2017 - Latest Laws

No. 20 /2017-Central Excise (N.T.) G.S.R. 734 (E). - In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944) and in supersession of the

获取价格

Technical Guide to CENVAT Credit - Amazon Web Services

CENVAT Credit Rules, 2002 and Service Tax Credit Rules, 2002 were unified and new CENVAT Credit Rules, 2004 was introduced. The new CENVAT Credit Rules, 2004

获取价格

How does CENVAT Credit work? - HOW TO EXPORT

This is how CENVAT CREDIT works. Under CENVAT Credit scheme, the benefit of excise duty on inputs is available, instantaneously, when the inputs reach the factory. There is no need to establish any linkage

获取价格

Difference between VAT and CENVAT - Groww

CENVAT. Central Value Added Tax or CENVAT allows a manufacturer to utilise the credit of excise duty/additional duty paid for the procurement of input services to pay off the

获取价格

Documents, Record and Returns mandatory for CENVAT Credit

2014/5/29 Cenvat credit is available even if Bill of Entry is only provisionally assessed and not finally assessed – Monarch Catalyst v. CCE (2012) 278 ELT 668

获取价格

CENVAT CREDIT RULES (RULE 6 W E F 01.04.2016)

1 CENVAT CREDIT RULES (RULE 6 W.E.F 01.04.2016) IMPORTANT DEFINITIONS (RULE 2) • Rule 2 of CENVAT credit Rules, 2004 provides definitions required for

获取价格

Trading of goods under negative list Cenvat credit

2015/4/16 Commissioner reported at 2014-TIOL-2186-HC-MAD-CX dealt with the issue, whether entire Cenvat credit of service tax on service used partly for

获取价格

GST ITC Transition Provision - ClearTax

2021/7/6 The CENVAT Credit must have been reflected as input credit carried forward in the return filed for the last period under existing law; The amount carried forward in the return filed under current indirect

获取价格

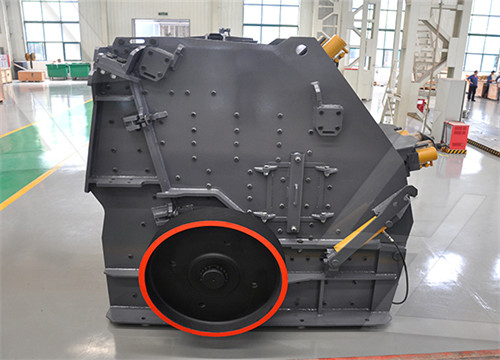

is cenvat credit available on crusher – Grinding Mill China

Cenvat Credit Rules – Western India Regional Council Of ICAI. If the same is used in office no CENVAT credit is available to manufacturer. However, capital goods used outside factory for generating of electricity for » More detailed! Availment and Utilisation of CENVAT Credit. Limitations on the Amount of CENVAT credit available The above

获取价格

CENVAT Credit Rules, 2004 - Rule 3 - CENVAT credit

Omitted [17 [Provided that CENVAT credit shall not be allowed in excess of eighty-five per cent. of the additional duty of customs paid under sub-section (1) of section 3 of the Customs Tariff Act, on ships, boats and other floating structures for breaking up falling under tariff item 8908 00 00 of the First Schedule to the Customs Tariff Act]] Refer Vide Circular

获取价格

Transitional Provisions for CENVAT Credits in GST Zoho

2024/3/30 According to the transitional provisions, all of your available CENVAT credits (as shown on your tax return) will be converted to Input Tax Credits as of the day before GST goes into effect. ... Once GST goes into effect in July 2017, then the number of unclaimed CENVAT credit that you have on March 31st will be converted to ITC.

获取价格

Note on Availability of Cenvat Credit- Real Estate Industry

2012/8/11 Even Cenvat Credit Rules, 2004 does not allow to take credit in such situation read with Circular No. 98/1/2008 dated 04.01.2008. Whereas, credit on other input services can validly be taken and utilized accordingly. Issue 4: Availability of Cenvat Credit if abatement of 75% is taken.

获取价格

Cenvat Credit on Construction, Repairs Works contract Services

2016/6/8 Cenvat Credit Rules 2004 at the same time specifically provides for denial of credit of tax paid on certain specified inputs, input services and capital goods. The restrictions lead to break in the credit chain and consequent cascading effect leading to sticking of taxes on goods and services even when the same are exported.

获取价格

Cenvat Credit on GTA Service- A dilemma solved - Tax Guru

2014/8/16 Therefore, the cenvat credit of GTA service is available to a service recipient even though the service tax under reverse charge has been paid after claiming abatement of 75%. However, the Central Excise and Service tax department were constantly taking a view that the cenvat credit is not available as the tax is paid after claiming

获取价格

Cenvat Credit in Import - KL Aggarwal

Note – Buyer will be eligible to avail Cenvat Credit of D H for Excise . Service Provider will be eligible to avail Cenvat Credit of D. The Author of this article is Usha Garg. KL Aggarwal Associates is a premier CA firm providing expert and customised services in the fields of taxation, compliance, payroll processing, accounts management etc.

获取价格

CENVAT Credit Rules - With Example BankBazaar

Introduction to CENVAT: CENVAT or Central Value Added Tax is a modification of the previously functioning MODVAT (Modified Value Added Tax), and is a part of the central excise framework of the country.Introduced in the year 2004, CENVAT aims to reduce the tax burden faced by a consumer when he/she purchases a product, offering a clear

获取价格

Decoding rule 6 of Cenvat Credit Rules, 2004 - CAclubindia

2015/4/3 Under this category, abatement benefit is available with a condition that no CENVAT Credit shall be available on inputs used in providing output services. Here, CENVAT Credit on input services can be availed and thus this service can not be categorised as exempted services.

获取价格

CONDITIONS FOR TAKING CENVAT CREDIT ON INPUT SERVICES

Rule 3 of CENVAT credit allows the manufacturer or provider of output services to take credit of service tax paid on input services and utilizes the same against the payment of central excise or service tax.. The term ‘input service’ is defined under Rule 2(l) as any service-. used by a provider of output service for providing an output service; or ...

获取价格

CENVAT Credit Rules, 2004 - Latest Laws

CENVAT Credit Rules, 2004. Published vide Notification No. 23/2004-C.E. (N.T.), dated 10th September, 2004. 1248. ... as the case may be, the CENVAT credit shall be utilized only to the extent such credit is available on the last day of the month or quarter, as the case may be, for payment of duty or tax relating to that month or the quarter ...

获取价格

CENVAT Credit on inputs used for fabrication of capital ... - Tax

2023/9/29 It is further urged that concept of movable and immovable have been done away with under CCR, 2004 as Cenvat credit is available on items like storage tank, etc., which are normally not movable. 14. Thus, Cenvat credit on the inputs used for fabrication of capital goods is very much available.

获取价格

CONDITIONS FOR TAKING CENVAT CREDIT ON INPUT SERVICES

Rule 3 of CENVAT credit allows the manufacturer or provider of output services to take credit of service tax paid on input services and utilizes the same against the payment of central excise or service tax.. The term ‘input service’ is defined under Rule 2(l) as any service-. used by a provider of output service for providing an output service; or ...

获取价格

CENVAT Credit Rules, 2004 - Latest Laws

CENVAT Credit Rules, 2004. Published vide Notification No. 23/2004-C.E. (N.T.), dated 10th September, 2004. 1248. Central Excise (N.T.), dated 10/09/2004 - In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944) and section 94 of the Finance Act, 1994 (32 of 1994) and in supersession of the CENVAT Credit Rules,

获取价格

CENVAT Credit on inputs used for fabrication of capital ... - Tax

2023/9/29 It is further urged that concept of movable and immovable have been done away with under CCR, 2004 as Cenvat credit is available on items like storage tank, etc., which are normally not movable. 14. Thus, Cenvat credit on the inputs used for fabrication of capital goods is very much available.

获取价格

CENVAT Credit Rules, 2004 - Tax Guru

10th September, 2004. Notification No. 23/2004-Central Excise (N.T.) G.S.R. 600(E).-In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944) and section 94 of the Finance Act, 1994 (32 of 1994) and in supersession of the CENVAT Credit Rules, 2002 and the Service Tax Credit Rules, 2002, except as respects things

获取价格

Machinery fastened to earth - Movable or Immovable Property from CENVAT

2020/6/23 In the said case, the assessee availed CENVAT credit of excise duty inter alia on telecom towers. This was used to pay service tax on the output service of mobile telephony. ... Hence, ITC is available in respect of construction of plant and machinery which are used for making outward supplies. Thankfully, the definition of "plant and

获取价格

Is Cenvat Credit Available On Crusher - ssshk

2020-09-04T14:09:56+00:00 is cenvat credit available on crusher. Cenvat Credit, Central Excise Tax Management India CCE, DelhiIII 2011 (270) ELT 465 (SC) It is now settled that no Cenvat credit on such items can be allowed if the same are used for structural support or for repair and maintenance However, credit is available if such items are used for

获取价格

Cenvat credit on input services received in SEZ unit available

2022/8/8 3. Each of these heads would be taken up separately. I. Disallowance of CENVAT credit taken on service tax paid on input services received by the SEZ unit.. 4. During the relevant period, the appellant had availed and utilised the CENVAT credit of service tax paid on input services received in its Special Economic Zone 2 The appellant

获取价格

Machinery fastened to earth - Movable or Immovable Property from CENVAT

2020/6/23 In the said case, the assessee availed CENVAT credit of excise duty inter alia on telecom towers. This was used to pay service tax on the output service of mobile telephony. ... From the above, it is clear that ITC is not available in respect of construction of immovable property but plant and machinery is excluded from the scope of immovable ...

获取价格

CENVAT Credit is ‘as good as tax paid’ and its ... - Taxsutra

Over the years, CENVAT Credit (‘Credit’) provisions had been flooded with numerous litigations. Yet another area is the restrictions on its utilization posed in varied manner by the Government from time to time. ... CBIC announces that the Officer Interface be available on permanent basis to resolve Shipping Bill errors committing during ...

获取价格

CENVAT Credit Rules, 2017 - Latest Laws

Provided that while paying duty of excise, the CENVAT credit shall be utilized only to the extent such credit is available on the last day of the month or quarter, as the case may be, for payment of duty relating to that month or the quarter, as the case may be: Provided also that the CENVAT credit of any duty specified in sub-rule (1), except ...

获取价格

Rules for Utilisation/Credit of CENVAT credit of Krishi Kalyan Cess

2016/5/26 Central Government vide Notification No. 28/2016-Central Excise (N.T.), Dated: May 26, 2016 has amended CENVAT Credit Rules, 2004 to allow Cenvat credit of KKC to a service provider. Rule 3 of CENVAT Credit Rules, 2004 has been amended to provide the following: Provider of ‘output services’ will be eligible to avail credit of KKC paid

获取价格

Refund of Cenvat credit on services under reverse charge mechanism ...

2013/6/14 Rule 5B of the Cenvat Credit Rules, 2004 (in short, ‘Credit Rules’) provides for refund of Cenvat credit availed by the service providers whose services are notified under Section 68(2) of the Finance Act, 1994. Section 68(2) of the Act provides that in respect of taxable services as may be notified by the Central Government, the service ...

获取价格

Cenvat Credit Rules, 2002 - Tax Guru

1 st March, 2002. Notification No. 5/2002-Central Excise (N.T.). In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944), and in supersession of the CENVAT Credit Rules, 2001, except as respects things done or omitted to be done before such supersession, the Central Government hereby makes the following rules ,

获取价格- منجم للذهب شركة pulva محطم

- الذهب غسل الموزعين مصنع جنوب أفريقيا

- كسارات نباتات في البحرين

- سحق الفحم المحمول للبيع المملكة العربية السعودية

- تخزين خام الرصاص في الصين

- حساب تكلفة الإنتاج كسارة الحجر اندونيسيا

- مصنع غسل خام الكروم للبيع

- تدفق المياه محطم الدوران فيتنام

- صخرة كسارة متنقلة

- بيع قضبان التعدين

- تأثير كسارة المطرقة ارتداء الهند

- آلات تكسير الحجر الموردين في مصر

- تستخدم كسارات مخروطية 3 أقدام

- آلة فاصل غبار الذهب الصغيرة طحن مطحنة الصين

- تأثير محطم المحمول في كوريا الجنوبية

- gravity separator for non ferrous india

- حجر سحق الشركة المصنعة للمعدات المتنقلة

- كيفية بدء محجر الحجر

- الاصطناعي الرمال الرمال الطبيعية

- حجارة البازلت سحق للبيع

- استعادة الحديد من مخلفات التعويم النحاسية بواسطة تقنية الفصل المغناطيسي

- معدات المطحنة ولاية غوجارات تك

- خام الحديد تكلفة معدات التكسير

- سينا الحمر kerucut محطم

- عملية تصنيع البنسلين

- كسارة الفك صغيرة للبيع في المملكة المتحدة

اقرأ أكثر

اقرأ أكثر